Marketing Chain for Beef Jerky Beef Jerky Pricing

Report Overview

The global jerky snacks market size was valued at USD iii.9 billion in 2019. The increasing demand for loftier-grade protein and intriguing flavors that provide quick energy to on-the-become consumers is expected to expand the telescopic of hasty snacks. This snacking trend is more visible amid the millennial consumer group as they prefer snacks that are less processed, made with natural ingredients, and are available in different flavors.

Jerky snacks are trending owing to its loftier-protein benefits. Consumers, particularly in North America and Europe, are switching from carbohydrate-enriched snacks to more nutritional snacks. Over the past few years, consumers' preference has shifted towards healthy snacks displaying the entire list of ingredients used. Consumers adopt more information on the packaging of the product. Clean labels, including non-GMO, gluten-complimentary, depression sodium, no artificial ingredients, minimal processing, and no antibiotics are raising trends in the industry.

Lately, snacking has become more popular among consumers equally compared to sit down meals. The growing dietary trend of shifting toward protein from carbohydrates is anticipated to lead consumers to take more meat than chips in the near future. Additionally, the availability of a wide range of flavors including habanero, teriyaki, maple, pineapple, sriracha, charcoal-broil, pepper, and sweetness cherry has been attracting consumers. However, upstanding issues can hinder the growth of the marketplace for jerky snacks in some countries including Bharat.

The growing need for the production over the by few years has immune both big and modest companies to enter the market. International companies dealing in the food manufacture such as The Hershey Company; Conagra Brands, Inc.; and General Mills, Inc. take entered the market place for hasty snacks by acquiring the existing firms. For instance, in January 2015, The Hershey Company bought KRAVE Pure Foods, Inc., producer of all-natural premium jerky. Through this acquisition, the company entered the marketplace to tap the quickly growing meat snacks demand. Similarly, in January 2016, Full general Mills, Inc. caused Epic Provisions, producer loftier-finish animal poly peptide. Furthermore, startups are inbound the market place with innovative and highly-seasoned names. This rising number of players is expected to increase competitiveness in the market for jerky snacks.

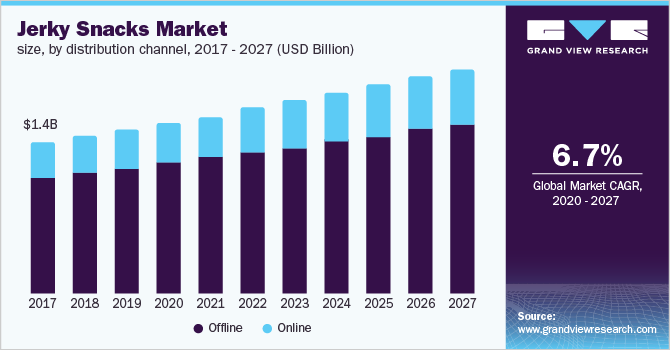

Distribution Channel Insights

The offline distribution channel held the largest share of the hasty snacks market in 2019 and accounted for over 75.0% of the total acquirement share. Supermarkets, hypermarkets, and convenience stores are still highly preferred past regular grocery shoppers. A large number of consumers beyond the globe buy food and beverages from traditional grocery stores or supermarkets. However, the online distribution channel is anticipated to expand at the fastest CAGR of seven.i% from 2020 to 2027.

The growth is attributed to the expansion of the e-commerce manufacture and the loftier penetration of smartphones across the globe. As a effect, the small and centre-sized manufacturers are strengthening their distribution channels past introducing their own online platforms. Online distribution aqueduct has widened the opportunity for the manufacturers, peculiarly for the small players. Through online platforms, companies can target better millennial consumers, i of the largest population groups. Amazon, Dickson's Farmstand, EPIC, People's Pick Beef Hasty, and Jerky.com are the prominent online retailers of the industry.

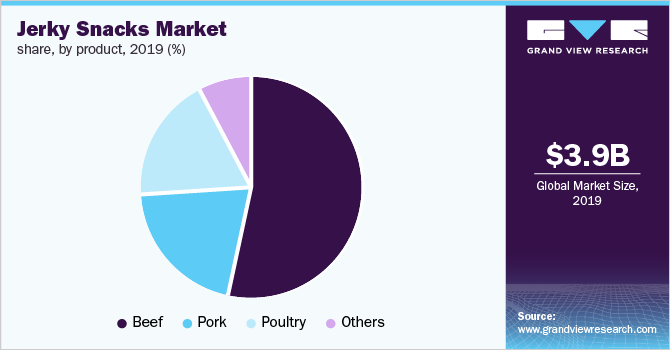

Product Insights

The beef segment dominated the market for jerky snacks with more than fifty.0% of the total revenue in 2019. These products are high in protein, minerals, and vitamins. The U.S. consumers prefer beefiness the most among the ruby meats. Traditionally, beefiness jerky was sold as an affordable, convenient, flavorsome snack and was primarily bachelor at gas stations and convenience stores. Over the by few years, the need for grass-fed beef has been emerging among consumers. Beef products account for more than half of the acquirement share of Jack Link'southward Beefiness Jerky, the dominant player of the market for hasty snacks.

Many consumers prefer beef products, every bit they tend to be more filling than other jerky snacks and are a better supplement for a meal. In addition, the beef products are more convenient owing to their lightweight and last for a long fourth dimension. This, in turn, makes them perfect for activities such as camping and hiking. Some consumers favor beefiness products owing to their health benefits such as high protein only low fat. These products have become a favorite source of protein for several health and fitness enthusiasts. Furthermore, the availability of the product in several flavors, including original, teriyaki, brindled, mild, and spicy, is also working every bit an appealing factor for consumers.

Regional Insights

Northward America dominated the market for jerky snacks in 2019 and accounted for 50.0% of the revenue share. As reported by the Simmons National Consumer Survey (NHCS) and the U.Southward. Demography, approximately 50.0% of the U.S. population, which is nearly 160 meg people, eat meat snacks and beef jerky regularly In U.S., jerky is one of the almost popular meat appetizers. Furthermore, the majority of the adult population of the U.Due south. eat snacks at to the lowest degree once in a 24-hour interval. This nation has the largest market for snacks in the world.

On the other hand, in Europe, the market place for jerky snacks is projected to expand at the fastest growth charge per unit of nine.8% from 2020 to 2027. The growth is majorly attributed to the increasing need for healthy protein enriched snacks along with rising sensation of a healthy lifestyle. Germany, U.Chiliad., Grand duchy of luxembourg, and Belgium are the potential markets of the region. The key companies have been entering the market to grasp the growing demand for hasty snacks. For instance, in September 2017, Jack Link's Beef Jerky planned to open up a new manufacturing facility in U.Thousand. to increase product capacity.

Jerky Snacks Market place Share Insights

The cardinal jerky snacks manufacturers include JACK LINK'S, LLC.; Old Trapper Beef Jerky; Oberto Snacks Inc.; The Hershey Company; General Mills Inc.; Chef's Cutting Real Jerky; Frito-Lay Northward America, Inc.; Tillamook State Smoker; Conagra Brands, Inc., and The Meatsnacks Group. The industry is largely dominated past JACK LINK'S, LLC. However, over the years, new players take been entering the market because the potential need for jerky snacks. Country Archer Jerky Co., Perky Hasty, Fusion Jerky, The New Primal, and Arizona Potable Company are the emerging players of the jerky snacks industry.

The players of this industry have been launching jerky snacks highlighting their natural, artisanal, and premium origins. In March 2016, JACK LINK'S, LLC. acquired Grass Run Farm, a supplier of grass-fed beefiness, for its new brand Lorissa'southward Kitchen. This will entreatment to the health-conscious and young consumers who are seeking for healthy snacks.

Report Scope

| Attribute | Details |

| Base year for estimation | 2019 |

| Actual estimates/Historical data | 2016 - 2018 |

| Forecast menstruation | 2020 - 2027 |

| Market representation | Acquirement in USD Million and CAGR from 2020 to 2027 |

| Regional scope | North America, Europe, Asia Pacific, Central & South America, Middle Eastward & Africa |

| Land scope | U.Due south., Germany, U.G., Mainland china, South korea, Brazil, South Africa |

| Report coverage | Revenue forecast, visitor share, competitive mural, and growth factors and trends |

| fifteen% free customization scope (equivalent to 5 analyst working days) | If you demand specific information, which is not currently within the scope of the report, we volition provide it to you as a part of customization |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and state levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this report, Grand View Research has segmented the global jerky snacks market based on the product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Beefiness

-

Pork

-

Poultry

-

Others

-

-

Distribution Aqueduct Outlook (Acquirement, USD 1000000, 2016 - 2027)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

N America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

Mainland china

-

Due south Korea

-

-

Cardinal & S America

-

Brazil

-

-

Middle Due east & Africa

-

South Africa

-

-

Source: https://www.grandviewresearch.com/industry-analysis/jerky-snacks-market

0 Response to "Marketing Chain for Beef Jerky Beef Jerky Pricing"

Postar um comentário